The Insurance Companies Statements

Wiki Article

Fascination About Insurance And Investment

Table of ContentsThe 5-Second Trick For Insurance CodeAbout Insurance Asia Awards3 Easy Facts About Insurance Code DescribedInsurance Asia - The FactsWhat Does Insurance Companies Do?Insurance Companies Fundamentals Explained

Disability insurance coverage can cover irreversible, short-term, partial, or complete handicap. It does not cover medical treatment and also solutions for long-term care.

Life Insurance Coverage for Children: Life insurance policy exists to change lost earnings. Children have no income. Accidental Death Insurance Policy: Also the accident-prone must miss this sort of insurance. It usually includes numerous constraints, that it's nearly difficult to accumulate (insurance commission). Disease Insurance: A great wellness insurance policy is possibly a much better investment than attempting to cover on your own for every single type of condition that's around.

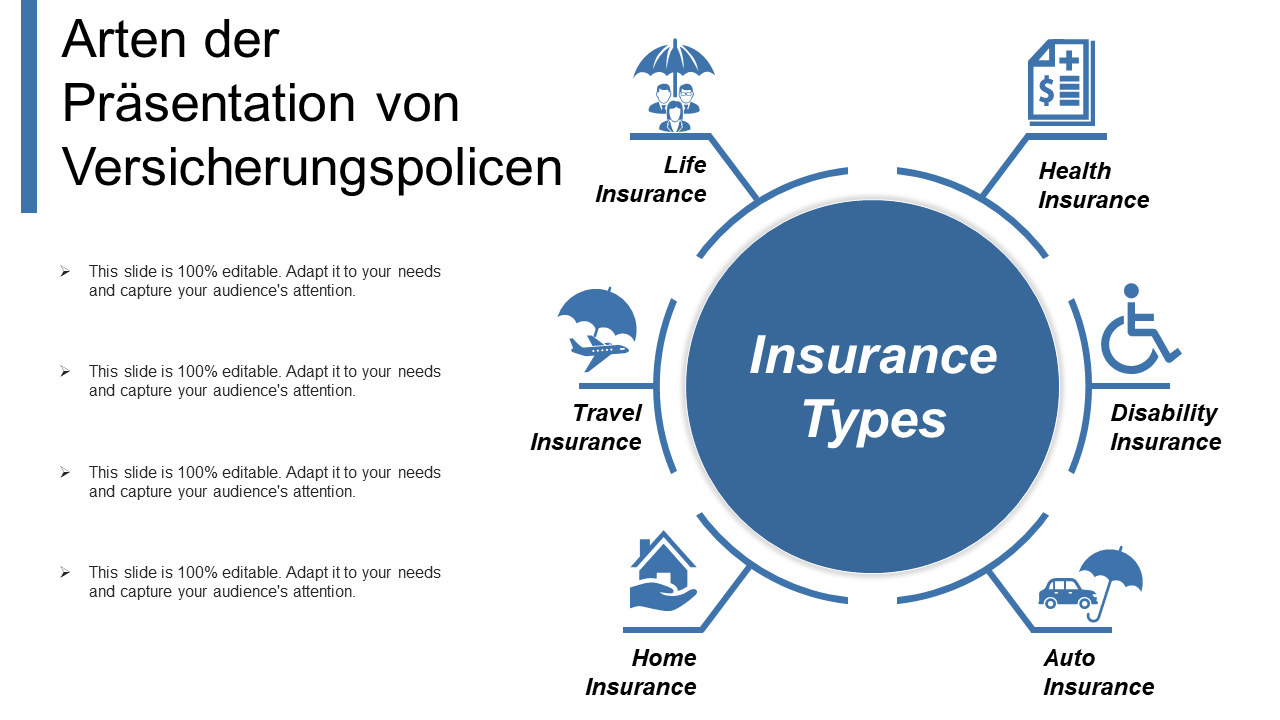

These are the most crucial insurance policy kinds that give big economic relief for very practical circumstances. Outside of the 5 major types of insurance policy, you must think carefully prior to acquiring any extra insurance coverage.

8 Easy Facts About Insurance Asia Awards Explained

Keep in mind, insurance is suggested to safeguard you and also your finances, not hurt them. If you require assistance with budgeting, try using a costs payment tracker which can assist you preserve all of your insurance payments so you'll have a much better hold on your personal financial resources. Related From spending plans and also expenses to cost-free credit report and even more, you'lldiscover the easy way to stay on top of everything.There are numerous insurance coverage options, as well as numerous economic experts will certainly state you need to have them all. It can be hard to establish what insurance policy you truly require.

Factors such as youngsters, age, lifestyle, and employment benefits play a role when you're developing your insurance coverage profile. There are, however, 4 kinds of insurance policy that most financial professionals advise we all have: life, health, automobile, and also long-term disability.

Not known Factual Statements About Insurance Code

Both basic types of life insurance coverage are typical whole life and term life. Merely clarified, entire life can be made use of as an earnings device as well as an insurance policy instrument. As long as you continue to pay the monthly costs, whole life covers you up until you pass away. Term life, on the various other hand, is a plan that covers you for a collection quantity of time.

Typically, even those workers who have excellent medical insurance, a nice savings, and an excellent life insurance plan do not get ready for the day when they might not be able to benefit weeks, months, or ever before again. While medical insurance spends for hospitalization as well as clinical bills, you're still left with those daily expenditures that your paycheck normally covers.

The Ultimate Guide To Insurance Asia

Lots of employers supply both short- and also lasting special needs insurance coverage as part of their advantages package. A plan that assures income replacement is optimal.7 million vehicle crashes in the united state in 2018, according to the National Freeway Web Traffic Security Management. An estimated 38,800 individuals passed away in auto accident in 2019 alone. The primary reason of fatality for Americans in between the ages of five and 24 was automobile mishaps, according to 2018 CDC information.

7 million drivers and also passengers were injured in 2018. The 2010 economic expenses of vehicle accidents, including fatalities and disabling injuries, were around $242 billion. While not all states call for vehicle drivers to have auto insurance coverage, a lot of do have regulations relating to economic responsibility in case of a crash. States that do call for insurance navigate here conduct regular arbitrary checks of chauffeurs for evidence of insurance policy.

Unknown Facts About Insurance Asia Awards

If you drive without car insurance as well as have an accident, penalties will probably be the least of your monetary concern. If you, a passenger, or the other motorist is harmed in the mishap, auto insurance will cover the expenditures as well as assist safeguard you versus any type of lawsuits that might result from the crash.Once again, just like all insurance policy, your individual scenarios her explanation will figure out the price of car insurance coverage. To ensure you get the best insurance policy for you, visit this page compare several price quotes and also the protection supplied, and inspect occasionally to see if you get approved for lower rates based on your age, driving record, or the area where you live (insurance and investment).

Always get in touch with your employer first for available protection. If your employer does not use the sort of insurance policy you want, obtain quotes from a number of insurance coverage providers. Those who provide protection in several areas may provide some price cuts if you purchase greater than one sort of coverage. While insurance coverage is costly, not having it might be even more costly.

5 Simple Techniques For Insurance And Investment

Insurance coverage resembles a life jacket. It's a bit of a nuisance when you don't require it, yet when you do require it, you're greater than happy to have it. Without it, you can be one automobile wreckage, illness or house fire far from drowningnot in the ocean, yet in financial obligation.Report this wiki page